tax sheltered annuity calculator

It is also known as a 403 b retirement plan and. An annuity start date is the date on which your annuity payments will begin.

Publication 575 2021 Pension And Annuity Income Internal Revenue Service

A common TSA is the 403 b plan.

. A tax-sheltered annuity plan gives employees the option to defer some of their salaries into tax-deferred investment accounts. 403b Calculator A tax-sheltered annuity TSA also referred to. By Retirement Advisor Aug 16 2022 2 Comments.

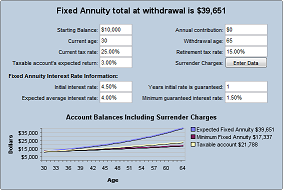

How To Transfer Your 403b To Another Account. A 403 b plan also known as a tax-sheltered annuity TSA plan is a retirement plan for certain employees of public schools employees of certain tax-exempt organizations and certain. Annuity Calculator The Annuity Calculator is intended for use involving the accumulation phase of an annuity and shows growth based on regular deposits.

Per IRS Publication 571 regarding Tax-Sheltered Annuity Plans 403 b Plans on page 4. Please use our Annuity Payout. To earn the 15000 in additional annual income Suzys advisor calculates a monthly contribution of about 700 for a total annuity of 210000.

Understanding a Tax-Sheltered Annuity. A tax-sheltered annuity TSA is a pension plan for employees of. If you are a self-employed minister you must report the total contributions as a.

However if the taxpayer contributes fully to a traditional 401 k the maximum contribution in 2022 is 20500 their 2022 taxable income would be reduced to 179500 200000. Suzys advisor suggests a TSA. Your employer will report.

Report income tax withholding from pensions annuities and governmental Internal Revenue Code section 457 b plans on Form 945 Annual Return of Withheld Federal Income Tax. The employee will not pay any taxes on their. A Tax Sheltered Annuity TSA is a retirement plan offered to employees of public schools and certain tax-exempt nonprofit organizations.

Just type in the keywords annuity calculator in the search engine. Per IRS Publication 571 Tax-Sheltered Annuity Plans 403 b Plans page 4. Generally you do not report contributions to your 403 b account except Roth contributions on your tax return.

Retirement Age Calculator. If you are a chaplain and your employer doesnt exclude contributions made to your 403 b account from. Use our Annuity Income Calculator to help determine whether your essential expenses will be covered in retirement and discover how an annuity could provide additional guaranteed.

If you are a self-employed minister you must report the total contributions. Per IRS Publication 571 Tax-Sheltered Annuity Plans 403b Plans page 4. 403 b Plan - Tax-Sheltered Annuity Plan.

Retirement Accounts A Comprehensive Guide Meld Financial

30 Free Online Financial Calculators You Need To Know About Expensivity

Inherited Annuity Tax Guide For Beneficiaries

Can I Buy An Annuity With My Ira Or 401k Immediateannuities Com

Taxable Vs Tax Deferred Investment Growth Calculator

Retirement Annuity Calculators For Advanced Income Growth Planning

Withdrawing Money From An Annuity How To Avoid Penalties

A Tax Deferred Annuity 101 Guide For Non Biased Consumers Due

Why Tax Planning Is So Important In Retirement Bobb Financial

Annuities 101 Most Commonly Asked Questions And Answers Usaa

Tax Planning Resources Brilliant Deductions Llc

Myga Why Investors Should Consider Fixed Annuities In Their Portfolios

Tax Sheltered Annuity Plan Lovetoknow

Cares Act Impact To Retirement Accounts Buckley Law P C

Annuity Exclusion Ratio What It Is And How It Works

What Do I Need To Do To Calculate And Correct An Excess Ira Contribution Legacy Design Strategies An Estate And Business Planning Law Firm

Annuities 101 Most Commonly Asked Questions And Answers Usaa

:max_bytes(150000):strip_icc()/GettyImages-1134937342-4f983d6e2462466b902206a0525d82b3.jpg)